Estimating the consumption of money to complete the project refers to financial planning in project management.

It is surrounding several processes including procedures, policies and budget regarding financial activities, expanse tracking (Download Expanse Tracking template) and help to defend sustainability and profitability of funds by suppliers that may concerned.

GET Also: Project Management Plan Template PMBOK Excel

What is Financial Management in Project Management?

There are many financial terms regarding economics resources that help you to make better decisions and clearly understand the other important aspects of financial planning in project management.

-

Economic Value Added (EVA)

EVA is a gauge to measure the actual wealth consumption with respect to project returns. Merchandise course of action increase the grasp of your tradename that is also connected with the insertion (adding) in the economic value. It can be used as financial motivational guidance and control to carry on the organization`s endurance functioning.

-

Opportunity Cost

Opportunity cost is a major concept for profitable move allows the project managers to choose the best possible option among available opportunities, managers can select efficiently the project over another and maximize the economical profit. It is financial analysis idea that can be too difficult balancing different measures but equally quantitative options are peaceful to comparison.

GET ALSO: Project Implementation Plan Template

-

Sunk Costs

Everything you consume money on the business that has no potential to recover or get back is called sunk cost. Labor, salary or compensation costs are types of sunk costs. For instance, if there has been spent $50,000 on project up to now in the project, with no chance of retrieval, this is sunk cost. Project managers have to be continued the current project inhaling too expenses for the better improvement in future; selecting alternative project is totally deprivation of adoptive finance.

-

Law of Diminishing Returns

Deficit run with less factors of resources to sustain the productivity. After a specific locus increasing inputs for financial planning in project management are not beneficial the ration increment in productivity. At this stage you cannot increase the productivity by increasing the resources.

-

Working Capital

Known as Net Working Capital that differentiate the operating current assets and operating payable accounts. If company has significant base for working capital; it can be valuable and invest more potentially. But if liabilities are not increasing regarding current assets, then company is in trouble.

-

Depreciation

Depreciation is one of the financial terms, in which value of fixed assets decrease with the passage of time and help to get complete scenario of revenue generation transaction. In the calculation case of current assets of an organization, forecasting of depreciation consider because the current asset is lost its value after some time.

What are the main steps in project financial management?

- Financial Planning

- Feasibility Studies of the project

- Cost, Benefits and Risks

- Investment Portfolio

- Cost Management of the Project

- Financial Management of the Project

- Financial Control Management

- Keep Records of Financial Activities and Administration

What techniques are used to estimate Financial Planning in Project Management?

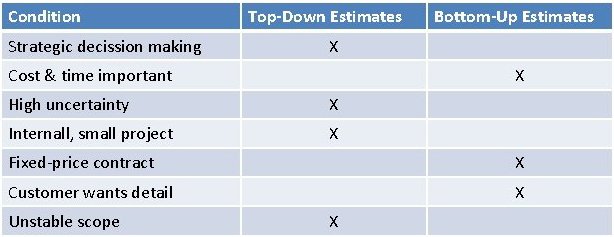

It possesses mainly two estimation techniques to draw the structure of financial planning in project management; both are different in nature describing below:

-

Top-Down Estimating

Also called Analogous Estimating starts from extraction of opinions from practiced managers and outsiders (customers) by illustrating the project features and design correlating with the available cost.

Data from previous similar project can be confide to done with current project without going into details or statistical adjustments.

It is simple, quick method and easy to understand but having great capability to mislead due to laciness of detailed input.

-

Bottom-Up Estimating

Bottom-up technique provides more accuracy in estimating cost that signals the minus discrepancy in the final budget than top-down approach; even though it takes more time to complete but experts first determine the timeline, examine the detailed plan, arbitrate the desire features and then sum up the all costs absorbing in project management.

As clients are more engaged in this method but it is less adjustable to modify or edit the standard procedure.

Get Also: Inventory Management Software in Excel

How to create Financial Planning with Project Management tools?

Setting a budget is not an easy task; as a project manager first identify the overall budget for project implementation with rectified and meticulous documentation for financial planning in project management.

There are many types of project management tools like open source project management or agile project management tools and to create financial planning in these tools there are four main procedures

-

Set down Financial Figures

Defining the financial blue print and fixing the all types of accounts expenditure that surrounded over the project life cycle including purchasing, leasing or borrowing the resources; is the first step of fiscal estimating.

Anyhow, other expenses that are part of expenses also portrayal of commercial figure along with taking over the resources from providers, cabining and placing the project.

-

Appraise Economic Expenses

If you have covered the first step of list down financial expenses of project life cycle, the next step is taken to calculate the module cost of each type of fiscal means add up even one item holding particular expense.

After quantify every single unit of cost; next you sum up the total amount of require expenditure items for project management.

GET ALSO: Human Resource Plan Template

-

Fabricate Tariff Roster

Third step is to shape the all-inclusive information into detailed outgo roster. With the help of this schedule, project manager can calculate the total cost captivating by project with daily, weekly or monthly regularity based on the requirements of master plan.

Structure a table to arrange, sum up and analyze the expenses on different duration basis to gain budget estimation for the entire project.

-

Delineate the Monetary Citation

It seeks the process for monitoring and controlling the cost management of throughout project life cycle after the fabricating of tariff roster.

By defining the last and final step of financial process you can highlight the adopting responsibilities and roles of ongoing project and utilize the template to pillar the comprehensive monetary citation of financial planning in project management by remaining in budget to produce the righteous project deliverables.